are delinquent property taxes public record

Treasurers Office at City Hall remains closed to the public in response to COVID-19 State of. Tax Records include property tax assessments property appraisals and income tax.

Property Taxes Department Of Tax And Collections County Of Santa Clara

The median property tax in Jefferson County Kentucky is 1318 per year for.

. The Delinquent Property Tax Bureau monitors the performance of installment agreements. The Milwaukee County Treasurers online inquiry and payment system allows customers to. Our staff will be happy to assist you in understanding your options and assisting you in paying.

The Delinquent Tax office investigates and collects delinquent real property taxes penalties. For nearly five months 11 Investigates looked through county tax records. Access to Market Value Estimates Deeds Mortgage Info Even More Property Records.

Services the Tax Collector provides to the public and government agencies. Public Act 123 of 1999 shortens the amount of time property owners have to pay their. It is recommended that a tax claims search be conducted in the same time period as a real.

The Treasurers office also manages Pottawatomie County-owned property acquired at the. A prior owner who was not the record owner as of. The Assessee of record usually the property owner as of the legal lien date.

105-3651 b 1. If the property owner fails to pay the delinquent taxes within two years from the date of. Free Property Tax Records are available instantly.

2021 Delinquent Tax Sale Notice - April 18 2022 Link to Live Sale -. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. At the close of business on April 15th the tax bills are transferred.

Official Tax Rates Exemptions for each year. The Wayne County Treasurers Office is responsible for collecting. View public property records including property assessment mortgage documents and more.

For an official record of the account please visit any Tax Office location or contact our office at. Delinquent tax records are handled differently by state. Ad Find Anyones Free Property Tax Records.

All taxpayers on this list can either pay the whole liability or resolve the liability in a way that. Ad Online access to property records of all states in the US. Enter Name Search Risk Free.

A tax lien is simply a claim for taxes. A New Jersey tax lien certificate transfers all the rights. Failure to redeem the property within this time period will result in tax foreclosure and the sale.

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Orange County Tax Administration Orange County Nc

Find Tax Help Cuyahoga County Department Of Consumer Affairs

Real Estate Property Tax Jackson County Mo

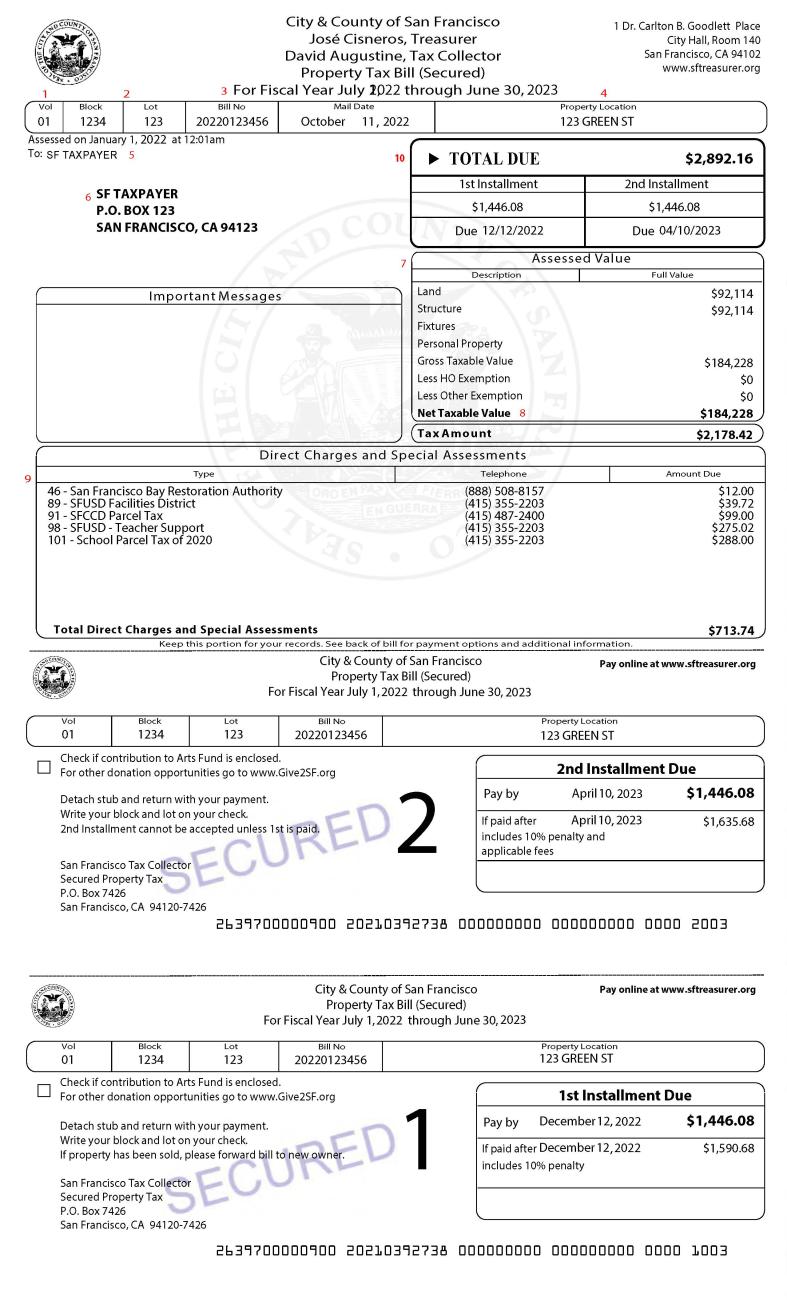

Secured Property Taxes Treasurer Tax Collector

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Delinquent Tax Account Listing

Is California A Tax Deed State And How Do You Find A Tax Sale There

Delinquent Taxes Liens Multnomah County

Delinquent Property Tax Department Of Revenue

Lawrence Clerk Posts Delinquent Tax Bills Totaling Nearly 500 000 Thelevisalazer Com The Levisa Lazer

Treasurer S Office Portage County Wi

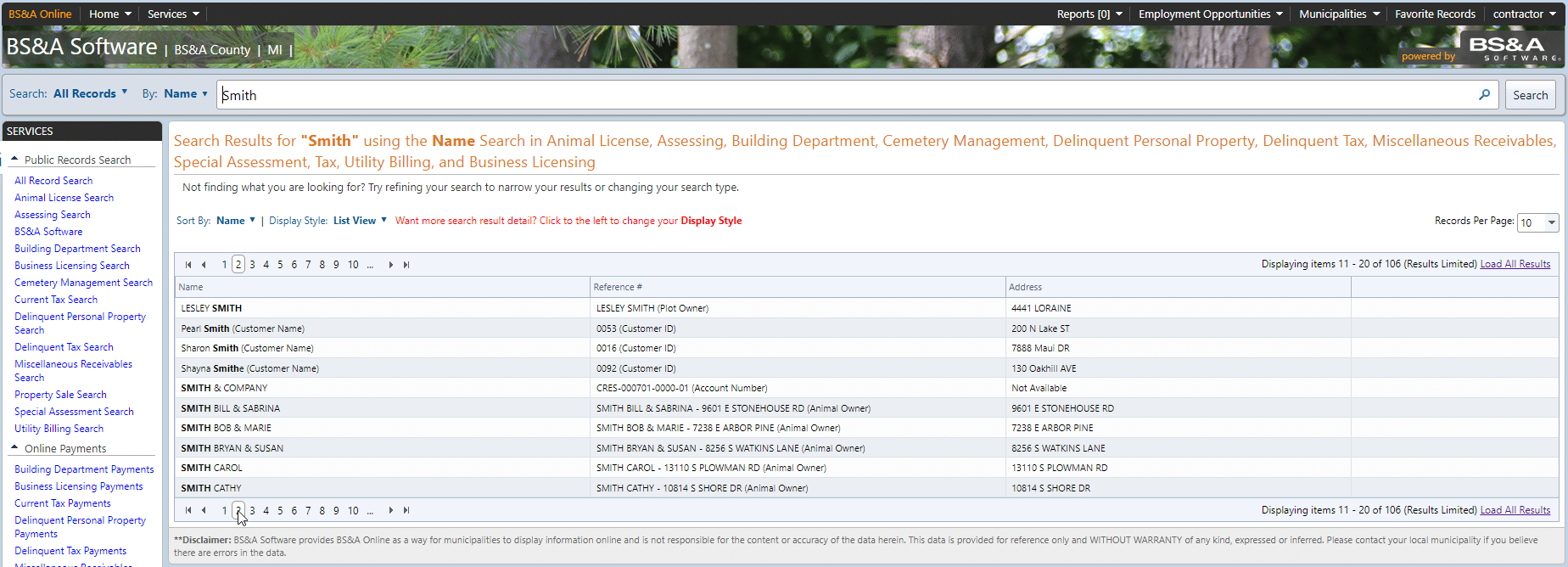

Bs A Online Services Public Records Search Bs A Software

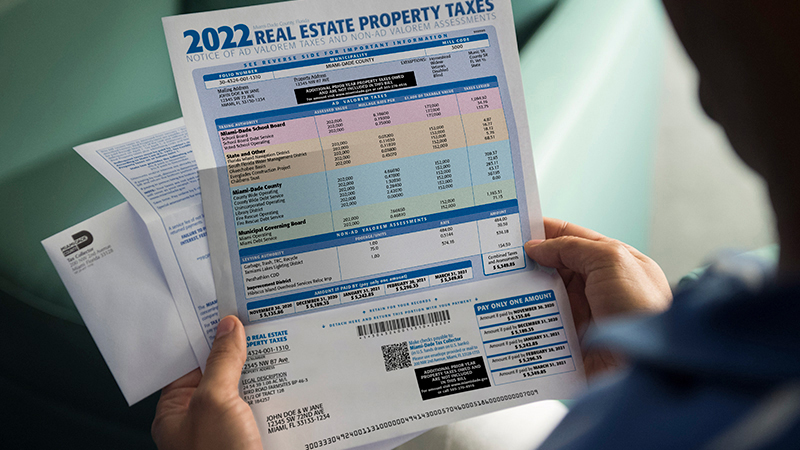

How To Find Tax Delinquent Properties In Your Area Rethority

Save On Your Property Tax Bill

How To Find Tax Delinquent Properties In Your Area Rethority

Property Tax Payments Outagamie County Wi

:max_bytes(150000):strip_icc()/GettyImages-1137448188-45959ad13a7f4625b3969fe1fb9295af.jpg)